Apply for Monzo Flex Credit Easy Guide To Get Approved Fast

Introducing Monzo Flex: A Flexible Financial Solution

In the ever-evolving financial landscape, the plethora of credit options can make choosing the right one feel like navigating a maze. Enter Monzo Flex, a credit solution that is quickly becoming the talk of Ireland. Rather than a traditional credit card, Monzo Flex operates more like a dynamic credit tool, tailored to meet the demands of contemporary financial lifestyles.

Convenience and Flexibility at Its Core

One of the standout features of Monzo Flex is its fee-free period for repayments. This means users can plan their repayments without worrying about hidden fees or sky-high interest. Especially for those in Ireland, where prudent saving is valued, this feature offers unprecedented control over personal finances.

Streamlined Application and Real-Time Updates

Gone are the days of tedious paperwork. Monzo Flex promises a quick approval process, allowing users to get started on their spending journeys almost immediately. Moreover, with real-time updates on every transaction, it delivers transparency, ensuring users are always in the loop about their financial status.

Versatile for Every Need

Whether you’re managing day-to-day expenses or handling unforeseen costs, Monzo Flex is designed for adaptability. Its straightforward and transparent terms make it an ideal choice for those who prefer clarity and reliability. As you explore its offerings, you’ll discover a seamless way to handle credit, making it a companion for your financial journey.

Monzo Flex isn’t just about offering another line of credit; it’s about enhancing your credit experience. As more people in Ireland look for smart, flexible financial solutions, Monzo Flex is ready to meet their needs with its user-friendly and innovative approach.

The Advantages of Using Monzo Flex

Flexible Spending Limit

Monzo Flex offers consumers the unique advantage of adjusting their spending limit according to their personal needs. Unlike traditional credit cards with fixed limits, this adaptability allows users to handle unexpected expenses with greater ease. It’s an ideal solution for budgeting because you can tailor your financial outlay, making it particularly useful for Irish households managing fluctuating monthly expenses. Tip: Regularly reviewing and adjusting your spending limit can help keep your finances aligned with changing situations and mitigate the risk of overspending.

Interest-Free Purchase Spread

One of the standout benefits is the ability to spread your larger purchases over installments without incurring interest when repaid within three months. This feature enables you to plan for significant expenses, like technology upgrades or travel arrangements, without the burden of immediate full payment. For long-term financial health, calculate your possible expenditures and incorporate these into your monthly budget to make the most of this feature.

Simplified Financial Management

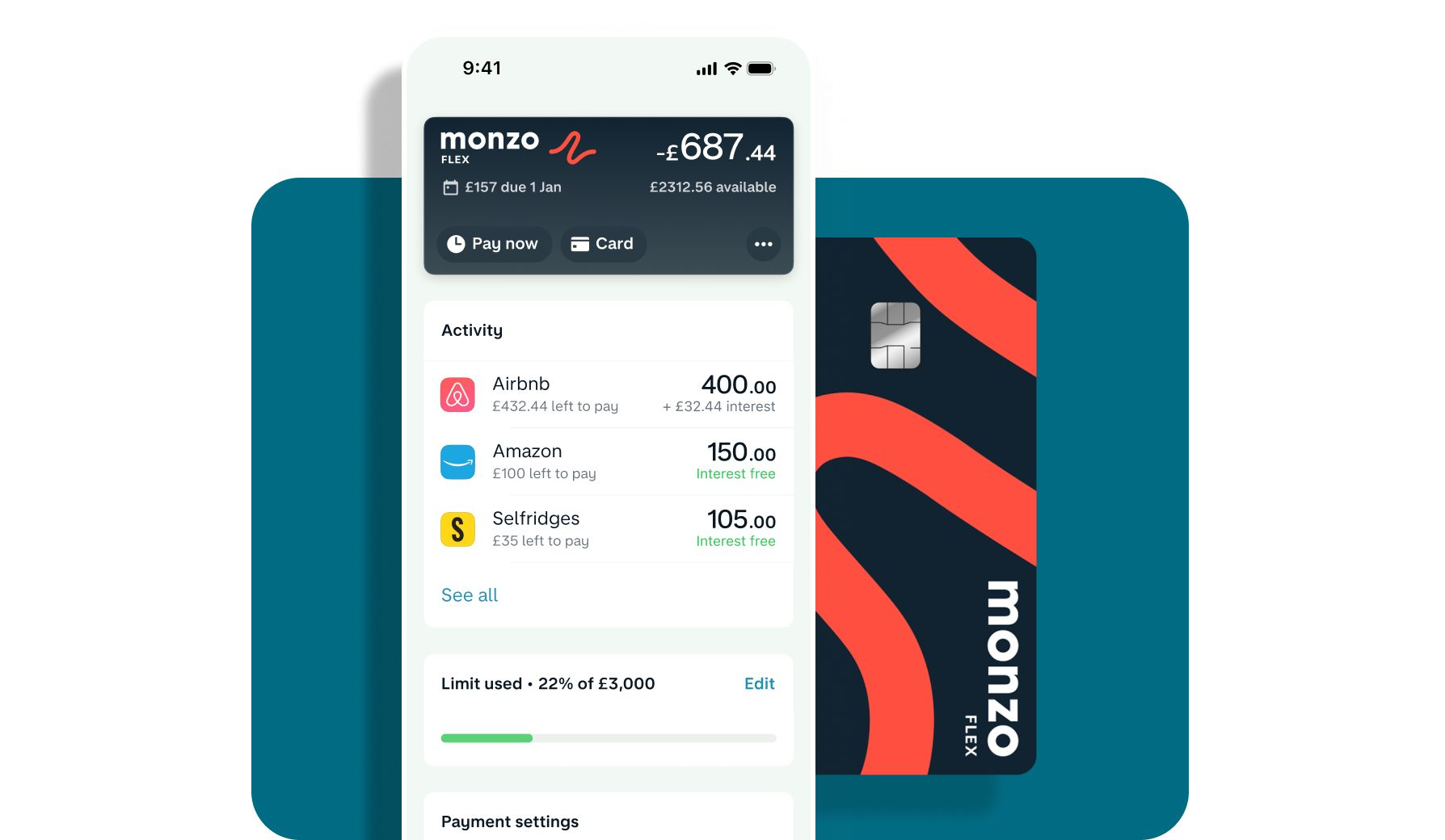

The Monzo Flex app provides comprehensive insights and easy-to-use features for tracking your spending habits. With clear visibility of your transactions, you can make more informed decisions about where to cut costs and how to allocate resources more efficiently. Tip: Utilize the app’s budgeting tools to receive alerts, helping you stay on top of your spending and avoid any unnecessary fees or penalties.

Seamless Integration with Monzo Account

Another significant advantage is that Monzo Flex integrates smoothly with your existing Monzo account. This integration facilitates both setting up and managing Flex directly from your Monzo app, ensuring a seamless experience. A consistent review of your Monzo account and Flex activity can help you maintain a strategic overview, optimizing your overall financial health.

GET YOUR MONZO FLEX THROUGH THE WEBSITE

| Category | Details |

|---|---|

| Flexible Repayment Options | Enjoy tailored repayment plans that adjust according to your financial needs. |

| No Interest Fees | Avoid any interest fees when paying off your balance in full by the due date. |

The Monzo Flex offering brings the freedom of flexible financial management. With tailored repayment options, you can easily adapt your spendings to suit your current budget, making it a wise choice for those with fluctuating expenses. Notably, Monzo Flex stands out with its zero-interest policy, where if you pay your balance in full by the due date, you’ll never incur interest fees. This feature is particularly advantageous for savvy spenders looking to maintain control over their financial health without the added pressure of accruing high-interest debts. By providing a solution catered to modern consumers, Monzo Flex positions itself as an excellent tool for individuals wishing to manage their finances intelligently. The flexibility ensures that unexpected expenses do not derail your financial goals, enabling users to navigate their economic landscape smoothly. Whether you need to finance a big purchase or simply manage daily expenses, Monzo Flex empowers you to make informed, strategic choices in your financial decision-making.

Eligibility Requirements for Monzo Flex

- The applicant must be at least 18 years old to apply for the Monzo Flex service.

- A regular income is essential for eligibility, ensuring the user can manage regular repayments; however, Monzo does not specify a minimum income.

- Applicants should have a Monzo Bank account, as Monzo Flex is offered exclusively to its existing customers.

- A positive credit history is crucial. Monzo conducts a credit check, assessing the applicant’s creditworthiness and repayment capacity through their existing financial history in Ireland.

- Valid proof of identification is required, such as a passport or driving license, to establish identity and residence status in Ireland.

- Applicants need to provide evidence of address, like a recent utility bill or bank statement, to verify their living status within Ireland.

GET YOUR MONZO FLEX THROUGH THE WEBSITE

How to Apply for Monzo Flex

Step 1: Access the Monzo Website

Begin your journey to financial flexibility by navigating to the Monzo website. This is where you’ll uncover the plethora of options Monzo Flex offers. For residents in Ireland, accessing the online application process ensures a streamlined and convenient experience. Dive directly into the details by heading to the application section designed specifically for your locale.

Step 2: Create or Log Into Your Monzo Account

If you’re not already part of the Monzo community, you’ll need to create an account. This involves providing some personal details, ensuring your financial engagements are securely linked to your identity. For existing users, a quick log-in will connect you to the application interface that already recognizes your banking relationship.

Step 3: Navigate to the Flex Application

Once logged in, explore the user-friendly dashboard to find the Monzo Flex application. This section is designed to capture your financial preferences and credit details effectively. Users will be prompted to provide employment and income information. Monzo’s intuitive system is engineered to evaluate your data swiftly.

Step 4: Submit Your Application

With all required fields completed, it’s time to submit your application. This step involves reviewing the accuracy of the details provided and agreeing to the terms and conditions. Once done, your application will enter the review stage where Monzo agents assess eligibility, taking into account your financial history and current standings.

Step 5: Receive Approval

Monzo Flex is devised to offer quick responses, and you will receive a notification when a decision is made. An approval confirms your credit limit and introduces you to the benefits of flexible spending, tailored to fit your lifestyle. Decisions are usually speedy, so keep an eye on your email or app notifications for updates. This stage marks the beginning of your new financial journey.

VISIT THE WEBSITE TO LEARN MORE

Frequently Asked Questions about Monzo Flex

What is Monzo Flex?

Monzo Flex is a flexible payment service offered by the British digital bank Monzo. Unlike traditional credit cards, it enables customers to spread the cost of purchases over several months. Think of it as a flexible loan facility aimed at providing financial ease without the burden of a conventional credit card.

How does Monzo Flex work?

After making a purchase, you can choose to split the payment over a period. Typically, the options include spreading payments over 3, 6, or 12 months. No interest is charged for 3-month repayment plans, but there are fees and interest rates applicable for longer terms.

Is Monzo Flex available to everyone in Ireland?

Currently, Monzo services are primarily available to UK residents, but their reach is expanding. It’s best to check Monzo’s official website or app for the most recent availability information in Ireland.

Are there any fees with Monzo Flex?

While Monzo Flex offers an interest-free option if you repay in 3 months, opting for longer durations can incur interest charges of up to 24% APR. It’s crucial to review the terms on each transaction, as terms may vary depending on the purchase amount and duration.

What are the eligibility requirements for using Monzo Flex?

To qualify for Monzo Flex, users must have a Monzo account. Monzo will also conduct a credit check to determine your eligibility and spending limits. It’s encouraged to ensure that you have a sufficient credit rating to enhance your chances of approval.

Related posts:

How to Apply for Avant Money Reward Credit Card Online Effortlessly

How to Apply for Danske Bank Mastercard Platin Credit Card Online

How to Apply for a Bank of Ireland Personal Loan - Easy Steps Guide

How to Apply for HSBC Rewards Credit Card Easy Guide Tips

How to Easily Apply for the Allied Irish Banks Click Visa Card

How to Apply for Danske Bank VisaDankort Credit Card Online

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the our platform. Her goal is to empower readers with practical advice and strategies for financial success.