How to Plan a Career Change Without Compromising Your Stability

Changing careers requires careful planning to maintain financial stability. Key strategies include assessing your finances, researching the new field, networking, and developing necessary skills. A structured transition plan and exploring part-time opportunities can provide security, ensuring a successful shift towards fulfilling professional goals.

Financial Planning for Independent Retirement

Effective financial planning is crucial for a secure retirement. Understanding various income sources, including state pensions and private savings, budgeting for expenses, and preparing for healthcare costs are essential. A well-thought-out strategy can enhance your quality of life and ensure financial stability in your later years.

The role of mindset in achieving financial freedom

Success in achieving financial freedom hinges on one's mindset, emphasizing the importance of a positive outlook, resilience, and continuous learning. By overcoming limiting beliefs, setting clear goals, and embracing a growth mindset, individuals can navigate challenges and cultivate lasting financial stability in an ever-changing economic landscape.

How to save money while renting

Renting shouldn't feel like a financial strain. By evaluating locations, negotiating with landlords, considering shared accommodations, and managing utilities wisely, renters in Ireland can significantly cut costs. This proactive approach helps create a sustainable living situation while enhancing financial well-being.

How to control small expenses that jeopardize the budget

Effective financial management is crucial for maintaining stability, especially in rising costs. Identifying and controlling small, everyday expenses can safeguard your budget. Practical strategies like tracking spending, setting clear goals, and adopting mindful spending techniques foster healthier financial habits, ensuring long-term stability and enabling savings for future needs.

Tips for Creating an Annual Budget and Staying in Control

Effective budgeting is vital for financial stability, especially in the context of rising living costs. By tracking income, categorizing expenses, setting clear financial goals, and regularly reviewing your budget, you can maintain control of your finances and adapt to changing circumstances for long-term success.

The difference between saving and investing: when to do each

Effective financial management requires understanding when to save and when to invest. Saving is essential for short-term goals and emergencies, while investing supports long-term wealth growth. Balancing both strategies, tailored to your financial situation and goals, helps ensure stability and growth in your financial journey.

Additional Card: How It Works and What the Risks Are

Additional cards offer shared access to credit for family members, facilitating household expense management. While convenient, they come with risks, including credit liability and potential overspending. Clear communication and responsible management are essential to harness their benefits while avoiding financial pitfalls.

How to Apply for Danske Bank Mastercard Platin Credit Card Online

The Danske Bank Mastercard Platin offers exceptional benefits, including comprehensive travel insurance, Priority Pass lounge access, and a rewarding points program. Enjoy zero liability protection for secure transactions and a 24/7 concierge service for personalized assistance, enhancing travel and lifestyle experiences effortlessly.

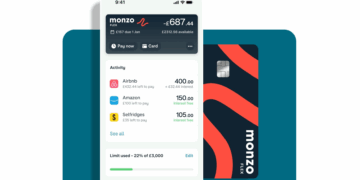

Apply for Monzo Flex Credit Easy Guide To Get Approved Fast

Monzo Flex offers adjustable spending limits for unexpected expenses, interest-free installment payments on large purchases, and streamlined financial management via its app. It seamlessly integrates with your Monzo account, providing easy access and a holistic view of your finances, perfect for effective budgeting and financial health.